investment-overview

overview

what-is-wisebanyan

Frequently Asked Questions

WiseBanyan is the world’s first free financial advisor. We're revolutionizing the financial services industry by allowing everyone to achieve their goals and reach financial freedom.

Up until recently, it was absurdly expensive to have your money managed professionally. But WiseBanyan is changing that. Through our technology and unique business model, we can help you start investing toward your goals free of charge. Simply tell us what you want to achieve and we'll automate your path to success: from building your financial plan to managing your investments. We charge no fees, and require no minimum balance.

With WiseBanyan, you can invest your way toward anything from retirement to a jet ski - for free.

WiseBanyan’s mission is to ensure everyone can reach their financial goals, regardless of their starting financial situation. We believe (and research shows) investing early and often is the key to financial success. However, until recently professional financial management has been a privilege reserved for those who already had a ton of money to start.

By having no minimum requirements to start and not earning money based off our clients' account values, we can empower our clients to start earlier, provide the best advice after they do, and keep our interests fully aligned as they progress.

Wise: We set out to provide the best way to help our clients maximize their wealth by investing wisely. We focus on this core principle for everything we build.

Banyan: The banyan is a type of ancient tree that has very special branches. After enough time, the branches actually turn into roots, strengthening the tree. Likewise, we believe that as our clients invest in their present, their future will be fortified.

WiseBanyan is the only firm to fully align its incentives with those of its clients. We purposefully designed our business model to not rely on charging fees based on the size of our clients’ accounts (otherwise known as the "assets under management" or "AUM" fee). This means we don’t earn money based on your account size, but rather for products and services that provide additional value to you.

The premise is simple: you can choose from additional products and services that are designed to add demonstrable value to your current financial situation rather than paying a "one-size-fits-all" asset-based (AUM) fee for services you probably won’t use. Our clients will never be obligated to select our services and can opt-in at any time based on our recommendation or their own intuition. The end result is we don’t need to require a minimum account size (because we don’t get paid based on the value of your account), we can provide the most objective financial recommendations (because we’re never trying to unnecessarily increase the value of your account), and we can value all clients equally (because it’s up to you to use our paid products and services).

We want to also say publicly that we don't make money off our clients by selling their personal information, receiving kickbacks/commissions for recommending investment funds, or showing annoying ads. Just because our service is free doesn't mean we're unprofessional.

Anyone over the age of 18 with a U.S. permanent address* and social security number is eligible (and encouraged) to become a WiseBanyan client.

*Includes all 50 states and Puerto Rico

Yes! Anyone with a U.S. Social Security Number and a U.S. address is eligible to become a WiseBanyan client.

Yes! You can download our iOS app here and our Android app here.

Nope! WiseBanyan is a SEC-registered investment advisor (RIA) and is already working with thousands of clients across all 50 U.S. states (and Puerto Rico)! You can see our registration by searching for our firm’s name on the Investment Adviser Public Disclosure website.

There are two primary reasons WiseBanyan can operate as the first free financial advisor.

First, we've significantly reduced the time and costs traditionally associated with financial management through the use of automation. By reducing our day-to-day costs we can pass these savings onto our clients.

Second, instead of charging an assets based management fee (i.e. making money based off how much money our clients invest), we only charge for optional products and services. This allows clients to pay for what they need, rather than paying a "one-size-fits-all" fee for services they currently can't or don't want to use.

By offering a suite of services designed to provide specific value to each client at various points in their financial journey, we can be both a profitable, long-term financial firm while fulfilling our immediate mission of empowering everyone to reach their financial goals.

We believe this is the direction our industry should be moving toward in order to fully benefit and align itself with the interests of its clients.

Nope, WiseBanyan doesn't charge any trading fees.

Negative, WiseBanyan doesn't charge any custodial fees.

No, WiseBanyan doesn't charge any closing fees.

However, if you want to transfer your current WiseBanyan portfolio over to another brokerage firm (as opposed to your linked bank account), our broker-dealer Apex Clearing charges a $75 fee for Personal Investment Accounts and $95 for IRAs to transfer the funds (more details here). We don't receive any money (or anything else) from this fee.

Our recommended funds each charge a low expense ratio, which is a fee their fund managers charge as a percent of managed assets. WiseBanyan does not receive any share of these fees, whether in the form of a revenue share, commissions, or kickbacks. This gives us the freedom to provide the best investment advice to our clients.

Our portfolios have an average fund fee of 0.12% and a range of 0.03% to 0.13%. Here is the breakout for each individual fund:

VTI: 0.05%

VEA: 0.09%

VWO: 0.15%

VGIT: 0.12%

VGSH: 0.12%

LQD: 0.15%

VGSH: 0.12%

SJNK: 0.40%

TIP: 0.20%

VNQ: 0.10%

VCSH: 0.10%

SCHB: 0.03%

SCHF: 0.08%

IEMG: 0.16%

VCIT: 0.10%

HYS: 0.55%

IYR: 0.45%

SPY: 0.11%

EFA: 0.32%

EEM: 0.70%

SHYG: 0.50%

ICF: 0.35%

Our minimum deposit is $1 (hey, we can't invest your money if there's nothing to work with), but you never need to maintain a minimum balance.

Your funds are securely transferred through an ACH transfer by our clearing firm, Apex Clearing Corporation. ACH stands for "Automated Clearing House," which is an electronic network used for U.S. financial transactions. If you are employed, there is a good chance you receive or have received your direct deposits using an ACH transfer.

We require an initial deposit when you create a milestone to fund your account. The minimum amount on this deposit is $1 and this money still belongs to you, it's simply to fund your account. After all, we can only make the magic happen if we have something to invest.

After you link your bank account, it takes approximately 1-3 business days for your bank to transfer your first deposit and 1 more business day for WiseBanyan to build your portfolio. If you log in during this period, you'll see your account is still pending. We'll send you an email letting you know when your first milestone is invested and ready to view.

Please note that sometimes your account may be pending because you have not yet confirmed your micro-deposits or because we need additional information from you to verify your account. Log into your account for instructions and check to see if we've emailed you. If you have any confusion, please reach out at support@wisebanyan.com

If you only see cash in your WiseBanyan account, that means your deposit has been completed and we're in the process of investing your funds. Check back in one business day and you'll see that cash traded in for ETFs.

Our clients' well-being is our number one concern and we take security extremely seriously. Your money is held in a brokerage account in your name with Apex Clearing Corporation, an independent third-party clearing firm registered with the Securities and Exchange Commission ("SEC") and the Financial Industry Regulatory Authority ("FINRA").

Your account is covered and protected by SIPC in the extremely unlikely event that the brokerage firm was to become insolvent. SIPC protects investors against losses that stem from the financial failure of a brokerage company. If a brokerage fails, SIPC will cover losses up to $500,000 with a limit of $250,000 for cash losses. Learn more about SIPC protection at sipc.org.

In addition to SIPC coverage, Apex Clearing Corporation has arranged for an additional $150 million of coverage across all its clients.

We're obsessed with security at WiseBanyan. Your information is fully encrypted, securely stored, and protected by our state-of-the-art technology. Incidentally, we don't sell your personal information.

We know it can be a little disconcerting to give personal information like your address and social security number, but we need this information to verify your identity. We want to make sure if we're opening an investment account in your name, you are who you say you are. Similarly, other accredited banks or financial advisors ask for the same information. Note that this process does not require a credit check. Read more about our security.

We only use your information in two ways: to comply with securities regulations to securely open your account and to provide the optimal financial recommendations to grow your wealth.

Your information will never be shared with any third parties (unless you request it). As your financial advisor, your trust is our most important asset!

Absolutely not - WiseBanyan will never require a credit check for any reason.

All WiseBanyan account assets are held in an individual brokerage account in your name with our clearing firm, Apex Clearing Corporation. Apex is a third party clearing firm, so this provides an extra layer of security for your funds.

Simply put, by linking your bank account we can seamlessly deposit and withdraw funds to and from your WiseBanyan account.

Additionally, linking your bank account ensures you have the authority to transfer funds in and out of the linked bank account. We want to make sure your money is 100% secure, and linking your bank account enables us to do so.

The Securities Investor Protection Corporation (SIPC) is a non-profit corporation created by the U.S. Congress to protect clients of brokerage firms that have entered bankruptcy. The SIPC covers up to $500,000 per client, which includes a $250,000 limit for cash. Please note the SIPC does not cover a client’s investment losses due to market volatility. Learn more on the SIPC.

We plan on providing you with the best financial management for life! But in case any of these instances occur, your funds are securely stored with our broker-dealer and SIPC insured for up to $500,000. In other words, your money will be safe!

We offer four types of milestones: Rainy Day, Retirement, Build Wealth, and Custom. Which type of milestone you choose to create is completely up to you, but this post can offer you some helpful guidance.

We calculate these based on several factors, including but not limited to your income level, net worth, and time horizon. Remember to keep your WiseBanyan account up-to-date to receive the most accurate recommendations!

You can create as many Custom milestones as your heart desires! However, you can only have one of each of the Retirement, Rainy Day, and Build Wealth milestones.

You can turn off your auto-deposit by entering $0 into your milestone plan; however, we highly recommend utilizing auto-deposit for two reasons:

First of all, auto-deposit keeps you on track to reach your milestones on time by adhering to the deposit schedule that fits your time horizon. Second, auto-deposit helps with dollar cost averaging, which means that over time, your account buys more shares when prices are low, and fewer shares when prices are high. You can discover more about the benefits of auto-deposit.

You can see your portfolio details on the Milestone Details pages on your dashboard. You can get to this page either from the overview page (click the milestone and then "View Details") or from the right hand menu (click "Milestones" and then your milestone of choice).

Every time you make a deposit, withdrawal, or earn dividends, WiseBanyan will strategically use these updates to rebalance your portfolio. This minimizes your tax consequences while keeping your milestones on track.

To get nerdy: when your account grows through deposits and dividends, WiseBanyan buys the most under-allocated securities relative to target to get you closer to your target allocation. If you withdraw funds, we'll first sell the most over-allocated securities relative to target. We'll also rebalance your portfolio if any portion strays by more than 5% from the target allocation.

Absolutely! When you create or edit a milestone, you can adjust your stock/bond allocation by using the bar slider on the second step.

To keep your milestones on track, WiseBanyan clients can't swap out the ETFs in your portfolio. Our investment team works diligently to create a fully diversified portfolio tailored to your financial profile. We've specifically chosen these funds due to their extremely low expense ratio (the average portfolio's blended expense ratio is 0.12%) and high diversification in various asset classes.

To keep your milestones on track, WiseBanyan clients can't add stocks/securities in your portfolio. Our investment team works diligently to create a fully diversified portfolio tailored to your financial profile. We've specifically chosen these funds due to their extremely low expense ratio (the average portfolio's blended expense ratio is 0.12%) and high diversification in various asset classes.

You can view your investment activity from your web dashboard by going to the menu on the right and clicking Funding -> Funding Activity, and then choosing from the 'Funding' or 'Trades' options at the top. Here you can view the various types of activity in your account, such as deposits, dividends, trades, etc.

On your mobile app, navigate to the Funding tab and then tap on the icon in the top right corner to find your Activity.

Roth IRAs are funded with money you've already paid income tax on, but you won't have to pay taxes (e.g. – capital gains) again when you withdraw from a Roth IRA, as long as you're 59.5 years old and have held the IRA for at least 5 years by the time of withdrawal. But there's an income limitation for Roth IRA contributions – you typically need to make under $118,000 (single filer) to qualify for the full $5,500 annual contribution. More info here on income limitation for Roth IRA.

Traditional IRAs do not have an income limitation. Contributions to a Traditional IRA are with "pre-tax" dollars, meaning you can take a deduction from your income for contributions made to a Traditional IRA. Keep in mind you have to take the tax deduction yourself on your tax return, or work with your tax preparer. However, withdrawals (aka "Distributions") from a Traditional IRA are subject to taxes at your tax bracket at the time of withdrawal. So if you anticipate being in a significantly lower income tax bracket by the time you withdraw funds from your Traditional IRA, this can work out in your favor.

Traditional IRAs also have Required Minimum Distributions ("RMD") during your lifetime, more info here. Roth IRAs do not have RMD requirements.

While everyone's tax situation is unique and it's important to spend some time with your tax advisor to make sure you understand your situation clearly, the general rules of thumb for choosing between a Traditional or a Roth IRA are:

- If you have a long time to go before you plan to start withdrawing money from your IRA, and you think your income tax bracket will be the same or higher when you retire as it is today, then a Roth IRA probably makes sense.

- This can work well for young workers who aren't at their peak earning years yet.

- If you think your income tax bracket will be lower when you retire than it is today, you may be better off taking the up-front deduction of a traditional IRA.

If after considering your current and anticipated future income and tax circumstances, and you decide that you prefer to have your retirement funds in a Roth IRA but you currently exceed the income limit for Roth IRA contributions, then you can consider a Traditional IRA to Roth IRA conversion (aka "Backdoor IRA Conversion").

WiseBanyan is not a tax advisor and this should not be construed as tax advice. Please consult your tax advisor before making any tax related decisions.

While everyone's tax situation is unique and it's important to spend some time with your tax advisor to make sure you understand your situation clearly, the possible benefits of converting a Traditional IRA to a Roth IRA are:

- No federal income tax on your withdrawals (aka "Distributions") if you are at least 59.5 years old (and have had your IRA for at least 5 years) by the time you start making withdrawals.

- Watch your money grow tax-free indefinitely because you won't have to take required minimum distributions (RMDs) during your lifetime.

- Leave the Roth IRA as a tax-free bequest for your heirs. Your heirs will have to take annual RMDs, but they won't have to pay any federal income tax on those withdrawals as long as the account's been open for at least 5 years.

WiseBanyan is not a tax advisor and this should not be construed as tax advice. Please consult your tax advisor before making any tax related decisions.

- Start with a funded Traditional IRA.

- Work with WiseBanyan to complete paperwork to convert the Traditional IRA to Roth IRA.

- Pay income taxes on amount of assets in converted IRA – keep in mind that Traditional IRA contributions are "pre-tax", so when you convert to a Roth IRA, which is funded with "post-tax" dollars, you will owe income tax on the amount of converted assets. More info here.

- Talk to your tax preparer/advisor to make sure you understand exactly how much of a tax bill you will get for converting your Traditional IRA assets to Roth IRA assets!

WiseBanyan is not a tax advisor and this should not be construed as tax advice. Please consult your tax advisor before making any tax related decisions.

- If your income, and thus your tax bracket, drops in the future, you could pay more in taxes to convert now than you would save by eliminating taxes later.

- If you have to use money from your Traditional IRA to pay for the conversion taxes, you'll give up the chance to have that money grow and compound tax-free.

- If you'd like to reduce the tax impact of a conversion, you can do a partial Roth conversion. But keep in mind, the amount you convert is generally considered taxable income; that is, you can't choose to only convert your nontaxable assets (and leave your taxable assets in the account).

- If you're under 59½, withdrawing money to pay the tax bill for a backdoor conversion would be a pretty bad idea, since you would also incur a 10% federal penalty. (State penalties may also apply)

- Ideally, you will have cash on hand to pay the income tax owed as a result of the backdoor conversion. If you need to sell appreciated assets to pay the conversion tax, the additional capital gains tax also reduces the benefits of a Roth conversion.

WiseBanyan is not a tax advisor and this should not be construed as tax advice. Please consult your tax advisor before making any tax related decisions.

Yes, yes, yes. Auto-deposit keeps you on track to your milestone goals and has the added benefits of dollar-cost averaging.

Dollar-cost averaging means investing a fixed amount on a regular schedule, regardless of market behavior. This means that you avoid buying solely at market highs and are more likely to invest when the market is low (which basically means buying assets on sale).

Fantastic question. Many new clients start with a monthly auto-deposit and later move into a weekly frequency - it really depends on what makes you most comfortable. You can read more about how to consider your auto-deposit frequency.

Weekly auto-deposits initiate the first business day of each week, monthly auto-deposits initiate the first business day of each month, and quarterly auto-deposits initiate the first business day of each calendar quarter (i.e. January, April, July, and October). After the deposits are initiated your deposit takes 2 business days to complete.

To update auto-deposit, click "Funding -> Update Auto-Deposit" on your side menu.

Simply enter how much you'd like your auto-deposit to be ($1 minimum, $50,000 maximum, or enter $0 to pause).

After you submit your update, the new amount will be added to your total weekly, monthly, or quarterly recurring deposits.

To start, click "Funding -> Update Auto-Deposit" on the side menu.

There, you'll see a drop-down menu below "Schedule Frequency." You have the option of choosing a weekly, monthly, or quarterly auto-deposit plan. Please keep in mind your new frequency will apply to all of your existing milestones, and proportionally update your recommended and planned amounts.

You can pause your auto-deposit at any time. However, if you put your auto-deposit plan on hold on the same day of your scheduled deposit, it will still take place. For example, if your weekly auto-deposit is set to take place on Monday you must disable your auto-deposit by 11:59 p.m. EST on Sunday. For best results, for weekly auto-deposit plans pause your auto-deposit the day before Monday, for monthly plans the day before the first of the month, and for quarterly plans the day before the first of the quarter. Please note, while we understand it can be frustrating to have a deposit go through when you don't want it to, the money in your WiseBanyan account is still yours.

Good for you for accelerating your financial goals! Sign into your dashboard. Click Funding → Deposit Funds to make a one-time deposit. Your deposit should be complete in 1-3 business days,

Absolutely! First, click the 'funding' tab on the right hand menu on your dashboard. Next, click the 'transfer funds' tab. You'll be prompted through instructions there. Please note you can't transfer funds from an IRA into another milestone.

Before you make your withdrawal, please take a moment to read this article which runs through all the considerations of doing so. If you still want to withdraw money, sign into your dashboard, click Funding → Withdraw funds.

We know when you withdraw money, you want to see it in your account immediately. However, withdrawals take 5-7 business days to transfer back to your bank account, because there's a lot going on behind the scenes:

Once you request a withdrawal, we begin liquidating securities to create the cash to be sent back to your linked bank account. We use this opportunity to bring your portfolio closer back to the target allocation by selling the most over-allocated securities first. Within those securities, we also choose the highest cost basis tax lots. This approach is intended to help you pay the least taxes possible as a result of the withdrawal or even realize a tax-loss which can be used to offset gains elsewhere and reduce your tax burden.

After trading is complete, it takes approximately three days for the cash to “settle” within your WiseBanyan account before it is sent via an ACH transfer back to your linked bank account. It typically then takes one additional day for your bank to process the ACH and make your funds available.

Please note that the value of your portfolio today is subject to change by the time you receive your funds. This is due to natural fluctuations in the market. If you submit a request to withdraw funds before 1:30 PM EST, it is processed at 2:00 PM EST that day. If you submit a request after 1:30 PM EST, it is processed at 2:00 PM EST the next day. We are unable to reimburse clients for the difference in proceeds resulting from market fluctuation between the initial withdrawal request and when the withdrawal request is processed.

This is due to natural fluctuations in the stock market. Although we do everything in our power to maintain the requested value after a withdrawal, you might notice a small variation in funds due to market volatility.

Absolutely! Email support@wisebanyan.com and we'll help you out. Please let us know the value of the funds you wish to remove and from which account.

Note: The only time to "remove excess funds" from your IRA is when you're contributed past the government-sanctioned limit. If you're simply withdrawing money from your IRA, you can go through the normal withdrawal process, but there may be early withdrawal penalties.

To update your email, we ask that you give us a call for security purposes. Don't worry: this only takes a few minutes.

646-593-8359

Yes! Sign into your dashboard and click Settings → Financial to change your bank account.

Yes! Sign into your dashboard and click Settings → Contact to update your address.

Yes! Sign into your dashboard and click Settings → Financial to update your financial information. Remember to keep your information up-to-date, including annual income and net worth, to receive the best recommendations.

Yes! But for security reasons, please email support@wisebanyan.com to get the ball rolling.

Two-step verification (TSV) is an opt-in feature for WiseBanyan clients to add an additional level of security to their WiseBanyan accounts. When TSV is enabled for your account, you will be prompted to enter a verification code anytime you request to make an update or access your personal information. Your verification code will be sent to your specified mobile device. TSV helps us confirm you are authorized to make the requested changes to the account.

When enabled, you will be required to enter a verification code if you request to update your password, update your profile information, or download your tax documents. We will send your verification code on each occasion via text message to your pre-specified mobile device. You are free to opt-in or opt-out from TSV at any time from your WiseBanyan dashboard. Click here to learn more on how to enable TSV.

You can enable two-step verification by signing into your dashboard, then clicking Settings → Security. From there, you'll be able to turn on two-step verification.

Note: make sure the phone number in your account information is the number you want to link with two-step verification (aka your cell number).

Please note that text message and/or data rates may apply depending on your current mobile carrier plan. We only use your phone number in two ways – to send verification codes upon your request and to contact you regarding your account (again upon your request). Otherwise, here’s an advanced high five for taking this highly recommended security step!

Fear not! Call us at 646-593-8359 and we'll help you out.

Yes! This process is super quick and easy. Just email support@wisebanyan.com.

Please email support@wisebanyan.com and include a letter from the FINRA member firm giving you permission to maintain your WiseBanyan account. We are also happy to send the FINRA member firm duplicate statements upon request.

Mint.com is currently working to sync with our system, but it's not fully integrated yet. Feel free to contact them if you'd like to see the process expedited!

If you're logged in to your Mint Account:

- Go to the main page.

- Click the "Accounts" option located in the top menu.

- Click the "+ Add Account" button located at the top of the list of your connected accounts.

- Search for WiseBanyan, and you should see "WiseBanyan-Beta" appear. Click to select this option.

- You will see the message, "WiseBanyan-Beta is in beta mode." Click the "OK, I'LL ADD IT!" button.

- Enter your WiseBanyan log in email and password, then click the "Connect Securely" button. This helps the Mint engineering team better understand how to connect their platform to WiseBanyan.

- Feel free to continuously remind the Mint team to take us out of Beta by sending them an email. (we're on it, too)!

At this time we do not currently support integration with Quicken.

We only use your friends’ email addresses to send them your invite to become a WiseBanyan client. Your friends can delete their invite at any time. We promise we will never sell or share your friends’ personal information (unless they request it).

We're sorry to see you go! First, let us know if there's anything we can possibly do to improve your WiseBanyan experience. Our support team is available to chat things over with you at (646) 593-8359. If you're absolutely certain you want to close your account, go to Settings -> Personal Settings -> Leave WiseBanyan. From there, we'll walk you through the process of closing your account, explaining any expected consequences such as taxes.

An ETF is a passive investment designed to track a certain index. This means they are cheaper than actively managed funds, like mutual funds. ETFs are traded like stocks. Because they hold multiple securities in one share, they add instant diversification to your portfolio.

Our investment philosophy is built upon four main pillars:

- The value of diversification

- Keeping fees as low as possible

- The value of passive investing

- Starting sooner rather than later

Diversification

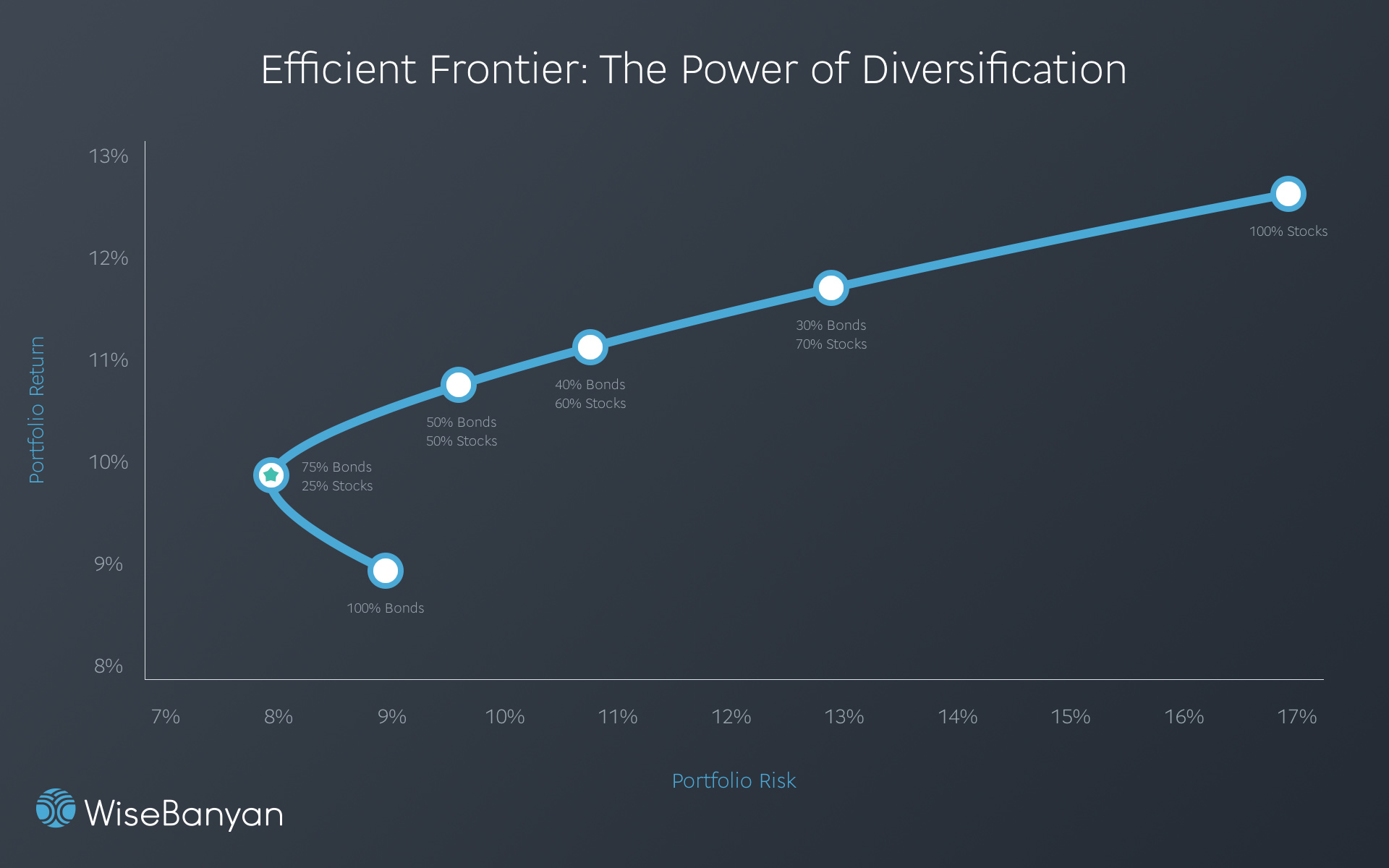

A diversified portfolio invests in a diverse pool of asset classes in order to create an investment strategy that seeks to have collectively lower risk than if you were to solely invest in any one individual asset. Diversification allows us to build portfolios properly tailored to each client’s preference to attempt to maximize returns at their preferred level of risk.

Low fees

Low fees allow investors to not only keep more of their hard-earned money, but also keep more of it working for them in the markets. This provides the added benefit of compound returns, or the phenomenon of growing your money faster through generating returns on top of previous earnings.

Passive investing

Passive investing refers to building portfolios that are designed to grow with the market long-term instead of trying to chase short-term fluctuations. Research continues to show that by shunning the high stakes game of active stock picking, investors can rise above psychological biases to capitalize on the growth of the markets.

Starting earlier

Nobody actually knows what the market will do tomorrow, next week, or a year from now. While it is tempting to "time" the market, it is much better to get your money invested sooner rather than later to take advantage of the rise in the markets. For example, investors that entered the stock market at the record peak of the S&P500’s value on October 11, 2007 and maintained their investments would have been up by 18% as of the end of 2013. (Google Finance: www.google.com/finance)

We use the tools of Modern Portfolio Theory to design the optimal portfolio for a given level of risk. In addition, we further optimize our investment process to minimize tax consequences and streamline the reinvestment of dividends and contributions. WiseBanyan estimates that our investment strategy will earn an investor, who initially deposits $100,000, over $300,000 above what he or she would have earned through more traditional investment methods. This estimation is based on a 30 year investment horizon, a historical 7% expected return, and a reduction of 2% in fees. This projection is for informational purposes only and should not be construed to be a guarantee of performance, past performance is not a guarantee of future returns.

WiseBanyan strives to maximize after-tax, real investment returns tailored to each client's tolerance for risk. We construct portfolios across different asset classes, customized to each of our client's risk tolerances. For investment purposes, we use a portfolio of passively managed exchange-traded funds ("ETFs") selected from a database of over 1,400 different ETFs based on their investment focus, tracking error, historical performance, and operational efficiency.

Our strategy focuses on Modern Portfolio Theory ("MPT"), which provides the framework for targeting the highest portfolio returns possible given a certain level of portfolio risk. MPT focuses on diversification, or the idea that asset classes and securities should move independently of each other. Correlations among asset classes are calculated: the higher the correlation between two securities or asset classes, the more similar their future performance. Following this, holding correlation constant, uncorrelated asset classes will not suffer similar price shocks at the same time (unless by chance); thus the inclusion of two or more uncorrelated securities will dramatically reduce the portfolio's risk. MPT combines securities in a single portfolio such that the return is maximized for any given level of risk.

To get nerdy, MPT relies on Mean Variance Optimization ("MVO") which constructs portfolios designed to capture the highest level of returns for a given target variance or volatility. We do however modify MVO somewhat and constrain allocations within the broad asset classes of equities and fixed income. (For the purposes of this constraint and due to the fixed payment schedule and interest rate exposure we include real estate in the fixed income portion of the portfolio). Whereas unconstrained MVO can yield lopsided portfolios, our method ensures proper diversification among sub-asset classes. Further, it also helps to account ahead of time for the increased correlations that we observe during times of market stress: international equities can be a poor diversifier for US equities during a severe market downturn, which is why it is beneficial to consider the risks of the equity bucket as a whole. Indeed, while many risks are at a macro level – interest rates, inflation, GDP growth, etc. – the most important consideration is the risks of an equity allocation as a whole rather than the consideration of sectors within that asset class relative to one another.

One of the key concepts in MPT is the concept of the efficient frontier. The efficient frontier can be graphed to display the highest level of expected return based on the set preference of risk. The example graph below plots the optimal portfolio to maximize returns for a given level of risk, based on the theory of the efficient frontier:

Any portfolio lying on the line is optimal, meaning that a higher return cannot be achieved without taking on more risk. Thus, the constructed portfolio is deemed efficient. Many casually constructed portfolios reside below the efficient frontier meaning they are not optimized to maximize returns for the given levels of risk. WiseBanyan constructs portfolios that start along the efficient frontier, and remain there through automated rebalancing. This keeps our clients' investments working as efficiently as possible. The framework for MPT was first introduced by Harry Markowitz in 1952 and later expanded upon in his book Portfolio Selection: Efficient Diversification of Investments published in 1959. Markowitz was awarded the Nobel Prize in 1990 for his work on Modern Portfolio Theory (www.nobelprize.org).

Figure 1.1: Efficient Frontier, The power of diversification

We begin our investment process by identifying global asset classes with which to build our portfolio. We consider each asset class' potential return and sensitivity to different economic scenarios such as interest rate movements, stagnating growth, dollar strength, and inflation. Finally, we calculate the risk of each asset class. In addition to the standard measure of risk and volatility, we also look at "worst case scenarios" such as maximum drawdowns. Most importantly, we calculate the correlation of each asset class to one another. If two asset classes are highly correlated and perform in a directionally similar manner, it can be best to hold only one asset class as the potential return is already captured.

When you first open an account with WiseBanyan, we'll ask you a few questions to properly construct your investor profile. When you create your first milestone, we'll use this information along with your financial targets and time horizon to build your recommended portfolio allocation. This recommended portfolio optimally weights each ETF to provide your desired amount of risk and potential return along the efficient frontier (learn more about that here). You can adjust your stock/bond allocation for each milestone at any time, and your recommended auto-deposit will automatically update according to the new risk-return preference.

Broadly speaking, the following asset classes are those that WiseBanyan analyzes for its portfolios:

U.S. Equities (Stocks) represent a claim of ownership in corporations based in the United States. Despite the slump in US Equities in 2008-2009, we have seen strong growth of the economy in the United States in the 20th century as well as the beginning of the 21st. Indeed, U.S. stocks have already made up all losses experienced during the recent financial downturn. Increasingly, U.S. corporations are conducting more business overseas, so they tend to benefit from growth in international developed and emerging markets.

To give investors access to U.S. equities, we use the Vanguard Total Stock Market ETF: VTI. For the purpose of WiseHarvesting, we also use the Schwab U.S. Broad Market ETF: SCHB and the State Street SPDR S&P 500 ETF: SPY.

Foreign Developed Market Equities (Stocks) represent a claim of ownership in foreign corporations based in developed nations (e.g. Europe, Japan, etc.). Foreign Developed Markets have experienced hardship of their own; however, they remain an integral part of the world economy. Similar to U.S. corporations, many foreign corporations have global reach and benefit from the growth of the world economy.

To give investors access to international equities, we use Vanguard FTSE Developed Markets ETF: VEA. For the purpose of WiseHarvesting, we also use the Schwab International Equity ETF: SCHF and the iShares MSCI EAFE ETF: EFA.

Emerging Market Equities (Stocks) represent `a claim of ownership in foreign corporations based in the world's developing economies (e.g. Brazil, Taiwan, South Africa, China, India, etc.). As a whole, Emerging Markets represent approximately half of the world GDP, although this figure is expected to grow as they further develop. While Emerging Market Equities are considered more volatile, they experience fast economic growth, and are expected to generate higher returns than the equities of their developed counterparts.

To give investors access to international emerging equities, we use Vanguard FTSE Emerging Markets ETF: VWO.For the purpose of WiseHarvesting, we also use the iShares Core MSCI Emerging Markets ETF: IEMG and the iShares MSCI Emerging Markets ETF: EEM.

U.S. Government Bonds are debt securities issued by the federal government and its agencies. These debt securities are used by the government to fund new or existing projects. Unlike equities, U.S. Government Bonds provide steady income in the form of interest and principal payments. U.S. Government Bonds are considered some of the safest investments in the world. While the returns can be far less than stocks, they provide good diversification and steady income to investors. In addition, Short Term U.S. Government Bonds have the added safety of minimizing interest rate risk, though they do yield less than intermediate or longer term bonds.

To give investors access to U.S. government bonds, we use Vanguard Intermediate Term Government Bond Index ETF: VGIT.

Prospectus: VGIT

To give investors access to short term U.S. government bonds, we use Vanguard Short-Term Government Bond Index ETF: VGSH.

Prospectus: VGSH

Investment Grade Corporate Bonds are debt securities issued by U.S. based corporations for the purpose of funding new and existing business activities; essentially they represent money that has been lent to U.S. companies which the companies pay back with interest. Because corporations are subject to higher credit risk and illiquidity than U.S. Government Bonds, they produce higher yields. These bonds are issued by corporations rated as investment-grade – meaning that ratings agencies have determined their risk is among the lowest of corporate bonds.

To give investors access to investment grade bonds, we use iShares Investment Grade Corporate Bond ETF: LQD. For the purpose of WiseHarvesting, we also use the Vanguard Intermediate-Term Corporate Bond Index ETF: VCIT.

To give investors access to short term investment grade bonds, we use Vanguard Short-Term Corporate Bond ETF: VCSH.

Prospectus: VCSH

Short Term High Yield Bonds are debt securities issued by U.S. corporations with a credit rating below investment grade. These securities generally have a higher yield than Investment Grade Corporate Bonds, and also carry a higher risk due to the credit worthiness of the issuers. Historically these securities have had more volatility of returns and have had a relatively high correlation with U.S. Equities. While all bonds carry credit risk – the risk the company will repay its debts – by investing in shorter duration bonds an investor can minimize exposure to additional risk in the form of interest rate fluctuations. By using Short Term High Yield Bonds, WiseBanyan seeks to minimize investors’ exposure and risk to a rise in interest rates.

To give investors access to short term high yield bonds, we use State Street Global Advisors Barclays Short Term High Yield Bond Index ETF: SJNK. For the purpose of WiseHarvesting, we also use the PIMCO 0-5 Year High Yield Corporate Bond Index ETF: HYS and the iShares 0-5 Year High Yield Corporate Bond ETF: SHYG.

Emerging Market Bonds are debt securities issued by the governments of developing nations. Historically, Emerging Market Bonds have faced higher instances of default than those of developed nations; however, this additional default risk is countered by the higher yields they offer.

Currently, we do not include emerging market bonds in our investor portfolios. This is because our model and investment process has determined that money is better allocated to emerging market equities and U.S. bonds. Were we to include this in our portfolio, we would use iShares USD Emerging Markets Bond Fund ETF: EMB

Municipal Bonds are debt securities issued by U.S. State and local governments for the purpose of funding new and existing public works projects. All interest earned from Municipal Bonds is exempt from federal income taxes, making municipal bonds attractive investments for investors in high-tax brackets. However, this tax benefit becomes irrelevant for IRA and tax deferred accounts.

Currently, we do not include municipal bonds in our investor portfolios. This is because our model and investment process has determined that money is better allocated to U.S. corporate bonds. Were we to include this in our portfolio, we would use iShares Municipal Bond ETF: MUB.

Treasury Inflation-Protected Securities (TIPS) are bonds issued by the federal government that are protected against inflation. As TIPS are inflation-indexed, their principal and coupon payments are adjusted against the Consumer Price Index (CPI). Because TIPS eliminates the inflation risk of nominal bonds, they earn lower yields than their non-protected counterparts.

To give investors access to TIPS, we use iShares Barclays TIPS Bond Fund ETF: TIP.

Prospectus: TIP

Real Estate Investments are U.S. real estate investment Trusts (REITs) holding both commercial and residential properties. While REITs may hold inherent risk of non-payment, they provide two major benefits. First rents increase with rising inflation, REITs protect investors against inflationary movements. Second, as prices rise either due to inflation or due to active management of the portfolio of properties, investors benefit from appreciation in the price of the REIT. Finally, Real Estate investments provide an opportunity for increased diversification of an investor's holdings.

To give investors access to real estate investments, we use Vanguard REIT ETF: VNQ. For the purpose of WiseHarvesting, we also use the iShares U.S. Real Estate ETF: IYR and the iShares Cohen & Steers REIT ETF: ICF.

Natural Resources reflect prices of energy and natural materials (e.g. natural gas, crude oil, precious metals, wheat, etc.) The major benefits of natural resources are similar to those of Real Estate, as Natural Resources provide inflation protection as well as the benefits that accompany a more diversified holding. Natural Resources investments are not subject to the capital gains tax until they are settled.

Currently we do not include natural resources in clients’ portfolios. This is due to the fact that, though prices of natural resources may rise, it becomes difficult to capture that price appreciation due to the cost of ownership and storage of natural resources. A natural resource ETF sponsor will need to use futures to gain exposure to natural resources, and futures are influenced not only by price movements but also by the cost of storage of the commodities. We find it better to offer clients inflation protection by using TIPs and real estate, as returns from natural resource ETFs have been quite poor. Were we to include natural resources in clients’ portfolios, we would use iShares GSCI Commodity-Indexed Trust ETF: GSG.

We outlined WiseHarvesting in full for your review, which you can read here.

Thank goodness you asked – you can’t imagine how long it took to write this thing…

WiseBanyan provides the following tax forms to clients:

- Consolidated 1099 Form (which can include the 1099-B, 1099-DIV, 1099-MISC, 1099-INT)

- 8949 Form

- 1099-R Form

- 5498

Which of these forms will I get?

- If you have a Personal Account or another kind of taxable investment account (this could be anything but an IRA)...

- and your account had any sells during 2016, then you will receive a 8949 Form.

- and your account had more than $10 in dividends in 2016 OR it had any sells during 2016, then you will receive a Consolidated 1099 Form.

- If you have any type of IRA...

- and you made any withdrawals from your IRA during 2016, you should receive a 1099-R Form by 2/1/2017.

- and you made any 2016 contributions, you should receive a 5498 Form by the end of May.

Please note this can include contributions you made during 2017 for the 2016 tax year and most people don't actually need the 5498 Form to complete filing their taxes, it is likely just for your records.

How do I know if I had any trades in my account?

- Go to Funding Activity (link) page.

- Select "Trades" at the top of the page.

- In the "Account" dropdown, select the account you are wondering about.

- In the "Activity Type" dropdown, select "Sell".

- If there are any Sells listed below for your non-IRA account, then you can assume that you will receive an 8949 Form and a Consolidated 1099 Form.

How do I know if I had more than $10 in dividends in my account?

- Go to the Funding Activity (link) page

- Ensure "Funding" is selected at the top of the page.

- In the "Milestone" dropdown, select any of the Milestones that say "Personal Account" next to them.

- In the "Activity Type" dropdown, select "Dividend".

- Add up all of the Amounts where the Date on the left says 2016. Once you go above $10, then you can assume that you will receive a Consolidated 1099 Form.

Absolutely! You can make a contribution to your IRA account(s) for the prior tax year up to April 10. Please consult IRS eligibility requirements and contribution limits first, and then follow the steps below to make your contribution:

Eligibility: IRA contributions must be made with "earned" money – or money earned from formal jobs and odd jobs. Please be aware of contribution limits for IRA accounts so you do not exceed those limits. You can learn more about IRA contribution limits on the IRS website.

Ready to make your contribution from the website? Please follow the steps below:

- Click the Funding option in the right menu

- Click Deposit Funds

- Enter how much you'd like to contribute to the prior tax year

- Select your preferred IRA

- Select your tax year (and double check how much you already contributed!)

- Click "Submit" and look for your confirmation email.

Ready to contribute for prior tax year from mobile app? Please follow the steps below:

- Click the Funding button on the bottom of the screen

- Click Transfer Funds

- Select From - your bank account; To - your preferred IRA.

- Click Make A Deposit

- Review your contributions for prior year and current year, then confirm a Tax Year for the contribution.

- Enter contribution amount, Review Deposit.

- Confirm deposit.

Deposits should be reflected in your account within 1-4 business days.

Note: Auto-deposit contributions are only for the current tax year and cannot be set to the previous year

Yes, you can view your IRA contributions for this year, and the previous year (until April 10th) by doing one of the following:

- To view your total current year contribution per IRA, go to your Retirement Milestone and look at "YTD" in the table.

- To view last year's total contribution on the website, go to Funding → Deposit, then select your IRA from the list. Next to each year, you will see the amount contributed so far for each year.

- To view last year's total contribution on the mobile app, go to Funding → Transfer Funds, then select your bank account and IRA for a deposit. On the following page, you will see the amount contributed so far for each year.

Alternatively, you can always view your IRA contribution by tax year by looking at your monthly statements under the section titled "retirement account information." You can view your monthly statements by logging into Settings → Documents.

Oh no! Fortunately, we (and the IRS!) have a process to help you remove any excess contributions you have made.

Step 1: Please fill out the following form and send it into support@wisebanyan.com. → Removal of Excess Calculation Worksheet

Step 2: Client services will get back to you with further instructions on how to fully remedy with The Tax Man.

Yes! You can make a prior year contribution to a new IRA with your initial deposit during signup. To do so, use the following process before April 10th:

- Start signing up for WiseBanyan!

- During Signup, choose a Retirement Milestone.

- On the Review Settings page, choose your preferred IRA from the dropdown list.

- Choose an auto-deposit (will count as current year contributions), fill out your personal information, link your bank, choose a password, and sign the agreement!

- On the following page click to "See Your Plan"

- On "Admire Your Plan", click "Update" next to your "First Deposit".

- On the next page, you can change your contribution to your preferred amount and choose the prior year!

- "Confirm Initial Deposit" and you're all set!

Yes! As of right now, WiseBanyan automatically integrates with the following 3rd party tax preparers:

- TurboTax

- TaxAct

- H&R Block

Integration means you can import the Consolidated 1099 Form from Apex Clearing directly through the tax preparer, and they should be accessible starting on February 20, 2017.

To import your WiseBanyan tax information, enter the first 8 characters of your Apex account number, into the "Account Number" field.

Remember not to use any dashes (e.g.: 5WB12345).

You can find your Apex account number on your most recent monthly account statement on your WiseBanyan Documents page.

As an investor, you will inevitably realize investment gains and losses along the way as your portfolio(s) are rebalanced and securities are sold. The IRS (herein referred to as "tax man") requires that these investment gains and losses are reported each year as you file your taxes.

To help with your taxes this year, we prepared a Form 8949 you can use to report realized gains and losses in your WiseBanyan taxable account(s). This form was prepared for all clients with a focus on allowing you to realize more investment losses, and thus, tax deductions.

Generally, we're not a fan of more documents; however, we'll make an exception for our Form 8949. WiseBanyan's WiseHarvesting software is able to designate specific tax lots to get more realized losses and accordingly, tax deductions, from the sales of securities in your taxable WiseBanyan account. We could have taken the easy way out and used the Form 1099- B prepared by Apex Clearing, but its software uses the "first-in, first-out," or FIFO, method of cost basis reporting. Both methods are accepted by the tax man, but we believe our method could allow you to realize more value in the form of tax deductions.1

Even if you didn't take advantage of WiseHarvesting in 2016, you should still consult our 8949 to see the difference in reported investment gains and losses as compared to Apex's 1099-B. Better yet, you should consult with your legal, tax, and/or accounting professionals before making any decisions. We know this is fun stuff, so please let us know if you have any questions.

Happy Tax Season!

– The WiseBanyan Team

1 WiseBanyan Inc. and WiseBanyan Securities LLC do not provide legal, tax or accounting advice. This material and all tax related documents provided is for informational purposes only. Please consult with your legal, tax and/or accounting professional before making any decisions.